AI stock rebound sets a positive tone for markets as Wall Street looks to recover from sharp losses driven by technology shares. Investors responded quickly to fresh earnings data and shifting global signals.

Futures Point to Early Gains

US stock futures moved higher before the opening bell. The S&P 500 futures rose modestly, while the Dow futures edged upward. Meanwhile, Nasdaq futures jumped sharply. These moves suggested relief after the market suffered its worst session in weeks. As confidence returned, traders positioned for a calmer session.

Micron Sparks Market Optimism

Micron delivered stronger-than-expected quarterly results. The company reported record revenue and profit. It also confirmed accelerating demand tied to artificial intelligence. As a result, Micron shares surged in early trading. This performance helped spark the broader AI stock rebound across major indexes.

AI Sector Finds Temporary Relief

AI-focused companies faced heavy selling pressure earlier in the week. Investors questioned whether valuations had climbed too far, too fast. However, Micron’s results eased some of that anxiety. Strong fundamentals reminded markets that AI investment continues to generate real earnings growth. Therefore, sentiment improved across the sector.

Chipmakers Lead the Recovery

Several technology leaders showed early gains. Broadcom, Oracle, and CoreWeave each climbed as buying interest returned. Semiconductor stocks benefited the most from renewed confidence. Since chips remain central to AI infrastructure, investors viewed Micron’s outlook as a positive signal for the entire supply chain.

Broader Market Movers in Focus

Outside technology, corporate news also shaped trading. Lululemon shares jumped after reports of activist investor involvement. This move highlighted continued interest in consumer brands with strong margins. Thus, the market found support beyond tech, adding balance to the AI stock rebound narrative.

Investors Await Inflation Signals

Traders stayed cautious ahead of key economic updates. Markets waited for fresh US inflation data later in the day. Inflation trends continue to influence interest rate expectations. Therefore, investors avoided aggressive bets despite early gains.

Global Central Banks Shape Sentiment

Overseas, central bank decisions influenced global markets. The Bank of England cut interest rates as inflation pressures showed signs of easing. This move supported European equities. At the same time, attention turned to Japan, where policymakers considered a rate hike despite economic contraction.

Mixed Performance Across Europe

European markets traded higher at midday. Germany’s DAX posted modest gains, while France’s CAC 40 advanced more firmly. Britain’s FTSE 100 also moved higher. These gains reflected optimism around easing inflation and stable growth prospects.

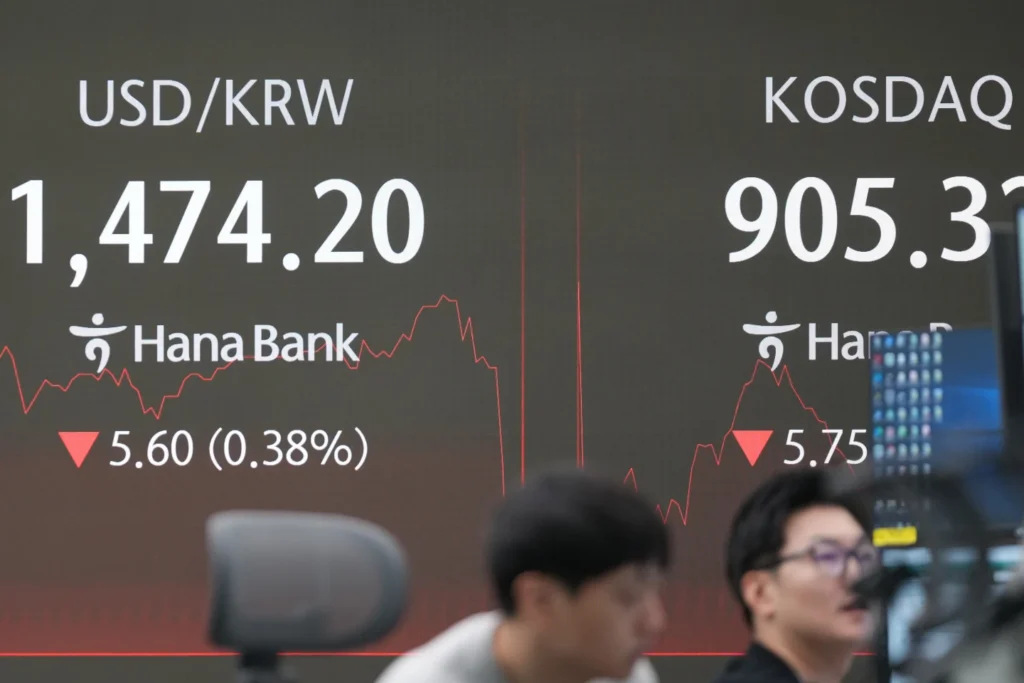

Asian Markets Show Caution

Asian stocks delivered mixed results. Japan’s Nikkei fell as technology shares declined. Major chip and electronics companies faced selling pressure. In South Korea, electronics and automakers also dragged indexes lower. These moves showed that global tech sentiment remains fragile.

China and Australia Trade Steady

Chinese markets ended mixed. Hong Kong shares recovered from early losses, while Shanghai posted small gains. Australian stocks finished nearly flat. These sessions reflected cautious optimism rather than strong conviction.

Energy Prices Offer Limited Support

Oil prices ticked higher in early trading. US crude and Brent crude both posted small gains after recent declines. However, oversupply concerns continued to weigh on long-term energy expectations. Energy stocks therefore played a limited role in the broader market mood.

Outlook Remains Data Driven

The AI stock rebound may continue if earnings support valuations. Still, investors remain selective. Inflation data, central bank actions, and future earnings will guide direction. For now, Micron’s results provided a timely boost to confidence and stability.

Leave a Reply