Nvidia AI Earnings have once again surpassed expectations, calming fears of an emerging AI bubble and reinforcing the company’s dominant position in the tech industry. As artificial intelligence continues to transform the global economy, Nvidia remains at the center of this technological revolution, powering AI factories with its advanced computing chips.

AI Demand Fuels Exceptional Growth

The latest Nvidia AI Earnings report revealed a significant surge in revenue and profit, sparked by the unstoppable demand for AI chips. The company reported $31.9 billion in profit and $57 billion in revenue, marking a remarkable increase from the previous year. Analysts were impressed, as Nvidia exceeded projected earnings of $1.26 per share by delivering $1.30 instead. This performance not only demonstrated strong investor confidence but also showcased Nvidia’s role as the heartbeat of AI growth.

Crushing Analyst Expectations

Nvidia AI Earnings also brought positive forecasts for the current quarter, with expected revenue around $65 billion. This number is nearly $3 billion higher than analyst predictions, further proving the company’s strong market momentum. Shares surged more than 5% in extended trading, potentially adding over $230 billion in shareholder wealth in a single day. Such results reflect investors’ belief that Nvidia’s growth is far from slowing down.

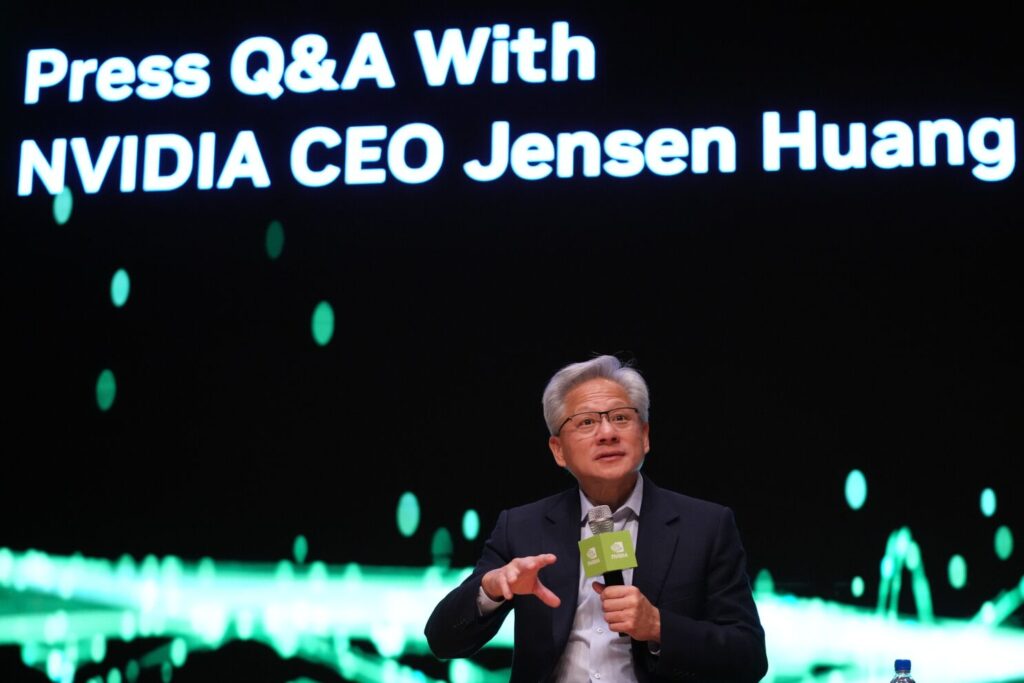

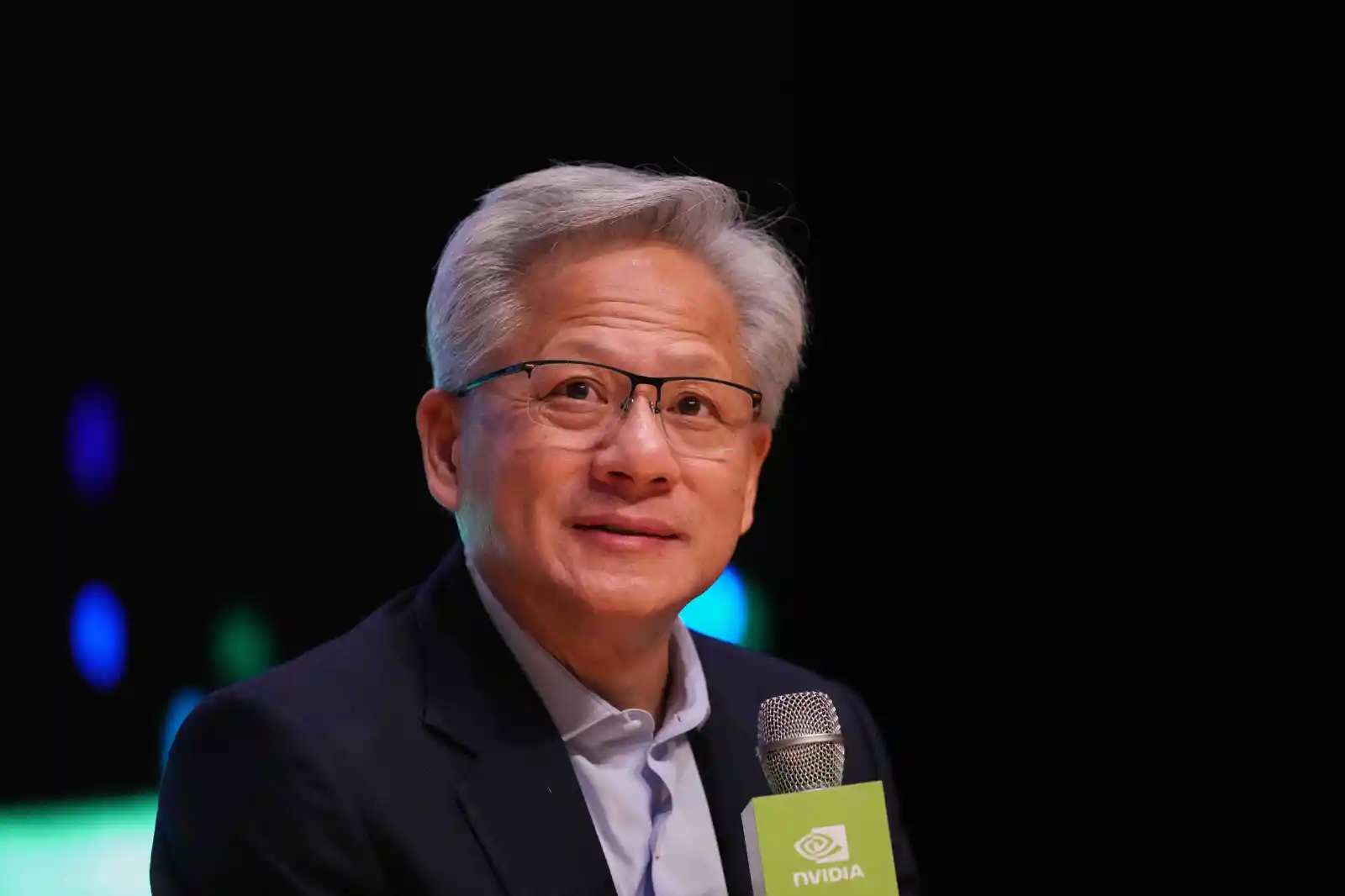

Leadership in AI Technology

At the core of Nvidia AI Earnings success is the company’s leadership in cutting-edge AI processors. The demand for its Blackwell chips is “off the charts,” according to CEO Jensen Huang. These chips power the AI factories that enable new advancements in automation, cloud computing, and digital innovation. CFO Collette Kress revealed that Nvidia expects to sell about $500 billion worth of AI chips within a two-year span, with trillions more in spending predicted by the end of this decade.

Addressing AI Bubble Concerns

Some critics have voiced concerns about the possibility of an AI bubble, fearing that the excitement around AI may be exaggerated. However, Nvidia AI Earnings proved otherwise. Huang emphasized that AI investment is not just hype but a real transformation in the tech world. He stated that the depth and breadth of AI growth are clear indicators of long-term impact, not a temporary boom.

Economic Influence and Global Impact

Nvidia AI Earnings also highlight the company’s growing influence on the global economy. The success of Nvidia has fueled growth for tech giants like Microsoft, Apple, Google, Amazon, and OpenAI. These companies rely heavily on Nvidia’s chips to build AI infrastructure. As a result, they now hold multi-trillion-dollar valuations. This rapid expansion shows how deeply AI technology is reshaping industries and financial markets.

Strategic Role in Policy and Trade

Nvidia has also emerged as a key player in international trade and government strategy. CEO Jensen Huang maintains close ties with political leaders, including President Donald Trump, as AI becomes essential for economic growth. Despite ongoing trade challenges that affect chip sales in China, Nvidia remains focused on innovation and expansion in other global markets.

Future Outlook for AI Innovation

The Nvidia AI Earnings report reinforces confidence in the future of artificial intelligence. The company’s leadership, innovation, and market dominance ensure that it will continue driving AI development worldwide. As more companies invest heavily in AI-driven services, Nvidia’s processors will remain in high demand.

Final Thoughts

In conclusion, Nvidia AI Earnings have not only defeated analyst expectations but also silenced skepticism about an AI bubble. With robust financial performance, strong market leadership, and unstoppable innovation, Nvidia continues to shape the future of AI-powered technology. The company remains a driving force in the transformation of industries, economies, and global digital infrastructure.

Leave a Reply